ADVERTISEMENT

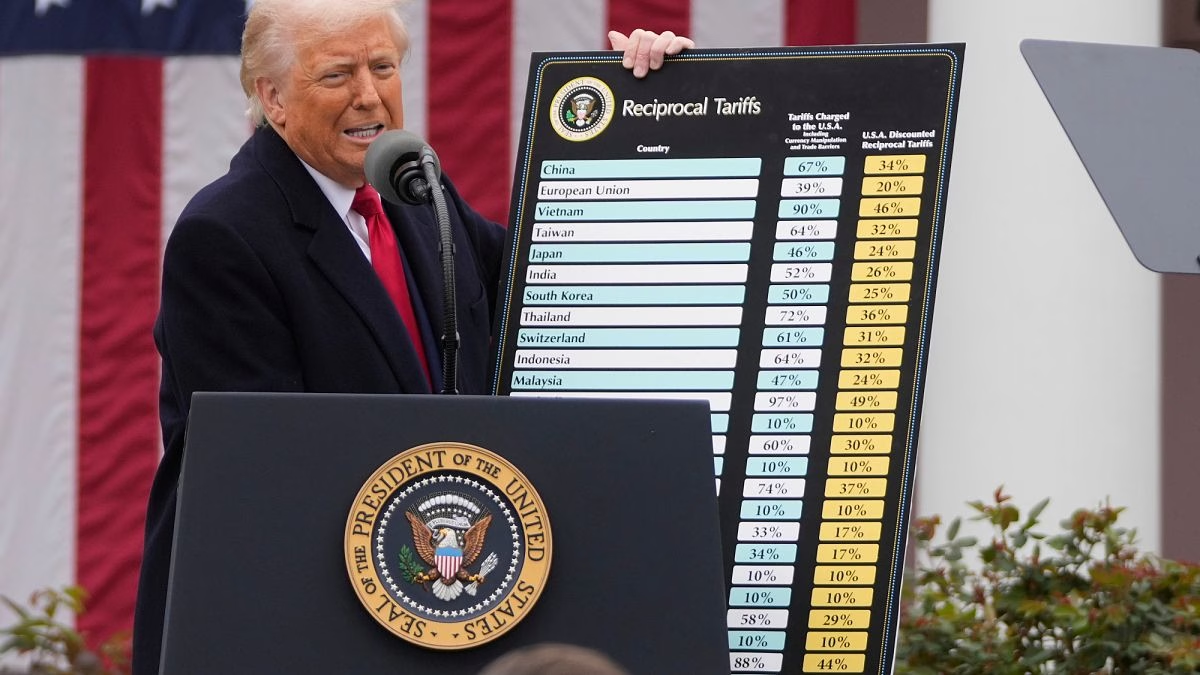

A court has determined that the 1977 International Emergency Economic Powers Act, which President Trump has utilized to justify significant increases in import duties, does not permit the imposition of tariffs.

A panel of three judges ruled on various lawsuits claiming that Trump exceeded his authority, casting uncertainty on trade policies that have unsettled global financial markets, frustrated trade allies, and raised concerns about inflation and the global economy. An appeal has been filed by the Trump administration, and it remains unclear whether the White House will temporarily halt its emergency tariffs in response to the ruling.

Despite many of Trump’s double-digit tariff increases being temporarily paused for up to 90 days to accommodate trade negotiations, businesses and consumers are hesitant due to the ambiguity surrounding their eventual outcome.

Stephen Innes of SPI Asset Management stated, “Just as traders thought they had seen every twist in the tariff saga, the verdict struck like lightning over the Pacific.”

At the very least, this ruling serves as “a brief respite before the next shock.”

The S&P 500’s prospects were up by 1.6%, while those for the Dow Jones Industrial Average improved by 1.2%.

Japan’s Nikkei 225 index surged by 1.5% to 38,263.36. The United States’ closest ally in Asia has urged Trump to revoke the tariffs he has imposed on imports from Japan and to cease the 25% tariffs on steel, aluminum, and automobiles.

The ruling also caused the dollar to rise sharply against the Japanese yen. It was trading at 146.06 yen early Thursday, up from 144.87 yen late Wednesday.

Australia’s S&P/ASX 200 gained 0.3% to 8,418.90.

In South Korea, which relies heavily on exports to the U.S. like Japan, the Kospi rose by 1.4% to 2,707.77. Shares were also buoyed by the Bank of Korea’s decision to cut its key interest rate to 2.5% from 2.75%, in order to alleviate economic pressure.

On Wednesday, U.S. stocks cooled off, with the S&P 500 decreasing by 0.6% to 5,888.55. Despite this, it remains within 4.2% of its record high, after climbing amid hopes that the worst of the turbulence caused by Trump’s trade war may have passed. It had been approximately 20% below this mark last month.

The Dow industrials decreased by 0.6% to 42,098.70, and the Nasdaq composite fell by 0.5% to 19,100.94.

Trading was relatively subdued in anticipation of the latest quarterly earnings release for Nvidia. These results were released after trading concluded for the day. Prior to that, the AI favorite’s stock slipped by 0.5%. In after-hours trading, it surged by 4.9%.

Like Nvidia, Macy’s stock also experienced fluctuations throughout the day, despite reporting smaller-than-expected declines in revenue and profit for the latest quarter. Its stock ended the day down by 0.3%.

Several other retailers also delivered stronger-than-expected results for the latest quarter. Abercrombie & Fitch soared by 14.7% after its profit and revenue exceeded analysts’ expectations. CEO Fran Horowitz attributed this growth to broad-based expansion across its global business, with strength in its Hollister brand offsetting weakness in its Abercrombie brand.

Dick’s Sporting Goods increased by 1.7% after surpassing analysts’ expectations for the latest quarter and reaffirming its financial forecasts for the full year.

The yield on the 10-year Treasury rose to 4.47% from 4.43% late Tuesday.

The bond market showed minimal reaction after the Federal Reserve released the minutes from its recent meeting, during which it left its benchmark lending rate unchanged for the third consecutive time. The central bank has deferred interest rate cuts, which would provide a boost to the economy, due to concerns about inflation remaining higher than desired as a result of Trump’s extensive tariffs.

In other transactions early Thursday, U.S. benchmark crude oil increased by 60 cents to $62.44 per barrel. Brent crude, the international standard, rose by 56 cents to $64.88 per barrel.

The euro declined to $1.1239 from $1.1292.