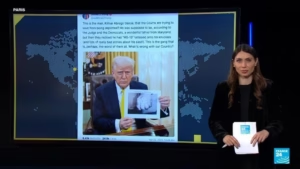

Stock markets around the world have surged following Donald Trump’s announcement that he plans to significantly lower tariffs on China and has no intention of firing Jerome Powell, the chair of the US central bank. This shift in tone comes after weeks of aggressive trade talk from the White House, which had unsettled investors. Trump further softened his stance, stating his intention to “be very nice” to China during trade talks and suggesting tariffs could decrease in both countries if a deal is reached. In Asia, stocks saw significant gains, with Japan’s Nikkei and Hong Kong’s Hang Seng both increasing, alongside South Korea’s Kospi. The positive trend continued into Europe, with major indices such as the FTSE 100, the FTSE MIB, the Dax, and the Cac all showing substantial increases. In the United States, stocks also opened higher, with the Dow Jones and NASDAQ Composite seeing significant rallies, although momentum slowed in the afternoon. Secretary of the Treasury Scott Bessent also took an optimistic tone regarding China, suggesting a move away from export-led growth. Investor confidence was bolstered by Trump’s statement that he would not fire Powell, reversing previous losses caused by Trump’s criticism of the Fed chair. The US dollar and oil prices saw gains, while gold retreated from a recent high.

Source: https://www.theguardian.com/business/2025/apr/23/stock-markets-rise-as-trump-says-he-will-reduce-tariffs-on-china-substantially