Major production companies in Australia, such as those producing shows like “Neighbours” and “Home and Away,” are potentially facing orders to pay millions in back superannuation due to a recent ruling by the Australian Tax Office in December 2024. The ruling, which aligns with the Superannuation Guarantee Act, concluded that screenwriters are generally providing services, not selling a product, and therefore are entitled to superannuation. This decision could lead to extensive backpay for decades of contributions for long-running series, despite the six-year statutory limit for individual employee claims in Australia.

The Australian Writers Guild (AWG) is preparing to confront Screen Producers Australia (SPA) over this issue, with the possibility of initiating legal action or a strike to enforce what they describe as the SPA’s “legally dubious” stance on the matter. This move parallels the 2023 screenwriters strike in the US, which, after actors’ involvement, significantly disrupted film production, including projects in Australia, underscoring the potential impact of such a dispute.

Clashes over compensation and the use of artificial intelligence were central to the US strike, with the AWG taking a similarly assertive stance. While the AWG, as a guild, is not legally bound to pursue protected actions, the potential for a “wildcat” strike looms, indicating the writers’ willingness to challenge the producers’ position despite the financial strain it could impose on their members.

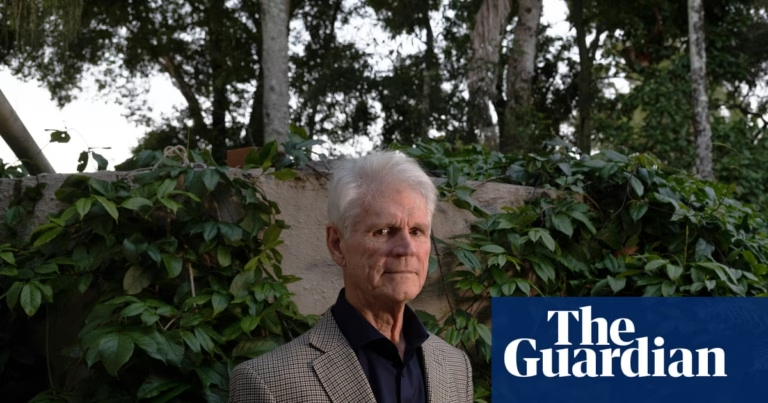

Peter Mattessi, a screenwriter and president of the AWG, argues that production houses have been treating legally required employer contributions as optional, highlighting the importance of legislation meant to protect workers against what amounts to wage theft. The AWG has faced challenges in addressing industry-wide non-compliance with the Australian Tax Office, which has not taken action on systemic issues, preferring to address each case individually rather than tackling widespread non-compliance directly.

The Superannuation Act clearly states that individuals paid for services in film, television, or radio production are considered employees and hence entitled to superannuation. The ATO’s recent clarification reaffirms this, differentiating between providing services (like writing a script) and selling a product, such as when a producer buys an existing script. Despite this, producers are advising screenwriters that payments are for intellectual property rights, not services, avoiding superannuation obligations.

Themultimedia content

Source: https://www.theguardian.com/film/2025/jul/18/film-tv-screenwriters-alleged-unpaid-super-at-australian-production-companies-ntwnfb